Like the rest of the economy, the automotive market was hit hard by COVID. Over the last couple months, sales have risen and advertising spend has followed.

The increase in advertising spend among automakers and related services is occurring at different paces. Plus, creative has gone through a major revamp.

Interested in the biggest changes? Let’s jump in.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

Automakers are feeling hopeful

The car industry was looking good at the beginning of the year. Through February, US car sales were up 8% YoY. In late March, COVID-19’s impact began and many dealerships shut down.

According to Edmunds, total April car sales hit their lowest level in 30 years in April, eclipsing the previous low of 655,000.

Despite the steep drop, sales were looking more hopeful in May.

“Retail consumers are coming out looking for cars and trucks,” said executive vice president of sales for Toyota Motor North America Bob Carter. “What hasn’t yet returned to the auto industry is the fleet commercial buyer, particularly rental car. Those sales continue to be suppressed at about 20%.”

In China, where the recovery is further along, May sales were up roughly 12% YoY.

Due to this optimism, ad spend from the auto industry is accelerating— it’s now almost double where it was at its lowest point.

When we look at the spend across different categories in automotive, we can identify interesting trends.

Luxury vs Mass Cars

Luxury automotive cars have seen their ad dollars recover much faster than mass brands.

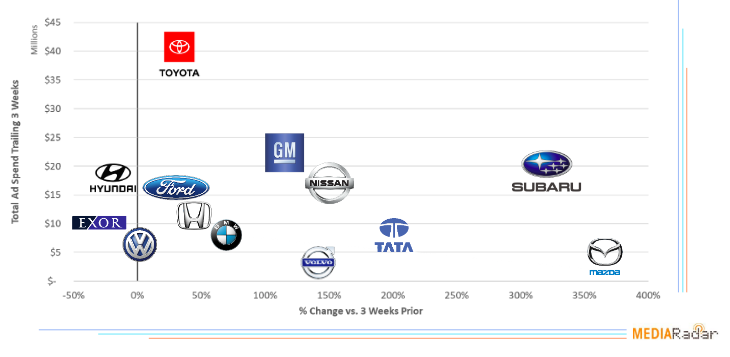

Comparing spending during the revival (5/17 – 6/6) to the three weeks prior, these are the increases among brands:

- Toyota: +34%

- GM: +120%

- Ford: +14%

- Nissan: +136%

- Mercedes Benz: +860% (It’s completely off the chart!)

Mass automotive remains by far the larger advertiser in terms of dollars, but the significant uptick among luxury carmakers reflects optimism in this sector.

RVs

Americans have been itching to travel, but want more freedom to avoid crowds and to feel safe with their lodging. That’s where RVs come in.

“On the road, opportunity is at your fingertips and you can spend time exploring all hidden gems between Point A and Point B that you’d miss from the air,” explains Jen Young, the cofounder and CMO of Outdoorsy. “RV travel also offers you the flexibility to change your plans and pivot your schedule in real-time.”

An all-American road trip is a classic vacation, and RVs make it more comfortable.

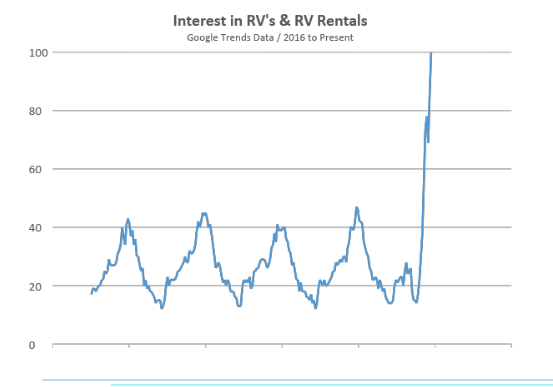

Google searches around RVs have more than doubled its previous high.

How have advertisers responded? RV company spend has increased 11 times YoY since May began.

It’s not only RVs that are responding. Automakers have tapped to this desire for a road trip by changing their creatives.

Changes in Creative

This spot by Kia is looking to play directly into the road trip trend.

The voice-over states: “It might be a while before we’ll see America from 35,000 feet, but the view from six feet is even better.”

The Kia spot is being run heavily on national TV on networks like NBC, ABC, Fox, CBS and USA.

While the ad spend and creative changes are looking positive among RVs and cars, motorcycle brands have been slower to bounce back. Spend is still down YoY by almost half.

Related Services

The car service industry is also on the rebound when it comes to ad spend. Here are some changes we’re seeing:

- Dealerships are not completely back up to pre-pandemic levels, but have risen from the initial drop of 50%.

- After an initial cut of 38%, insurance is up 12% YoY.

- Car service spend, from mechanics and repairs shops, is up 12% YoY.

- Car maintenance, accessories, fluids, etc. was up YoY for the first time in ten years.

While some sub-sectors haven’t fully bounced back, the ad spend from the automotive industry as a whole is looking like it’s on an upward track. We’ll keep checking in as our economy transitions.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.